Make budgeting easy in 2018 with one of the best budgeting apps available.

1. Monefy (or ‘Mint’ in the USA)

Monefy connects to your bank account to take some of the hassle out of creating a budget yourself. With access to your information, Monefy can help you by giving you personalised tips on how to budget more effectively, based on your income and spending habits. It provides you with a comprehensive look at your accounts, and will automatically sort and graph your spending, making it easy for you to track spending at a glance. Monefy uses the same security systems as most banks, so you can be confident that your details are safe.

Monefy is available on both iPhone and Android.

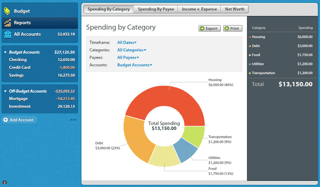

2. You Need A Budget

YNAB promotes making small changes in every aspect of your finances to build you a better financial future, rather than constraining you with a tight budget that is hard to stick to. The service also includes online video classes that give you tips on how to spend and save more responsibly.

YNAB is available on PC, Mac, iPhone, and Android. You can try YNAB free for 34 days before paying $5 per month, or $50 for a year.

3. HomeBudget

HomeBudget with Synch is a great app for a couple or family, as it allows you to share the budget among multiple devices. This app is easily manipulated, so would be well suited to those who want a lot of control over their budget. HomeBudget could also be a good choice for users who want to break down their budget into specific categories, or for those who have expenses that differ from the category breakdowns.

HomeBudget is available on most devices, and is $6.49 on iPhone and iPad, $6.49 on Android, $19.99 on Mac and $14.99 on Windows.

Please be aware that HomeBudget needs to be purchased for each separate device.

4. Spendee

Spendee is not exactly a budgeting app, moreso one to track where you are spending your money. Figuring this out is the first step to building and sticking to a budget. Spendee gives you a colour coded and clearly marked breakdown of your spending, and can indicate which areas you might be overspending in. Spendee also provides a graph showing your total spending over a week, and can compare to weeks prior.

Spendee is available for free on Android and iPhone, with premium features from $1.99.

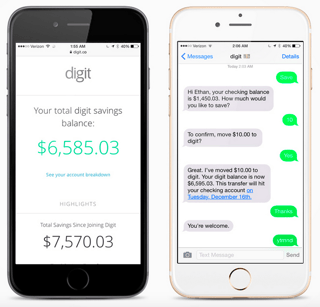

5. Digit

Digit is a free app that uses your income and spendings to calculate how much you can afford to save each month. It then will automatically put this amount into your savings account. Digit has been running since 2015, and since then has helped its users save over $250 million. Digit is a great app to help those who find it hard or stressful to save money, by doing it automatically. Digit is currently working on a service for business owners that will automatically calculate tax owed and put it into a separate account for the end of financial year.

Digit is available for iPhone and Android.

6. Albert Budget App

The free Albert Budget App can be linked to your bank account, as well as insurance, investments and loans. The app will filter through your account and draw your attention to any ongoing service or subscription payments that you may want to cancel. The Albert app gives you tips to become more financially healthy, and will be able to alert you to cheaper services such as insurance and credit card interest rates, giving you the chance to switch providers, which will save you money in the long run.

The Albert Budget App currently only available on iPhone, however the Android version will be released in early 2018.

Beyond Debt is a trading name of DCS Group Aust Pty Ltd. Australian Credit License: 382607. RDAA Number: 1126. PO Box 3074 Newstead, QLD, 4006.

DCS Group operates under a Limited Liability scheme approved under Professional Standards Legislation