Superannuation is a very important topic for people in any stage of their working career. It's something that young people may not think about, and one that retirees sometimes think too much about! So what exactly is superannuation and how does it work?

Superannuation is a sophisticated way to save money for your retirement. Superannuation providers will pool the money of multiple clients and expertly invest it, increasing the value of your savings that you will be able to access upon retirement. Your employer will make contributions to your allocated super fund each time you are paid, and you can make manual or set automatic contributions yourself as well.

There are many superannuation funds available to you in Australia. Your employer may be able to recommend one for you when starting a new job, or you can do the research yourself by using a comparison site. Some industries have preferred super providers which you can enquire about online or through your employer.

If you are self employed, you will not, of course, have an employer who deposits into your superannuation fund for you. If you are self employed, you must take on the responsibility of super contributions yourself. Superannuation is perhaps more important for those who are self employed or work on a freelance basis, because as soon you stop working, it is likely that you will stop being paid. We recommend setting up automatic super contributions to be deposited into your chosen funds each month or fortnight. Depending on your contributions, you may be able to claim them as a tax deduction. Speak to your super provider or accountant for more information.

Some people may be eligible for contributions from the government into their super funds. Low income earners who make less than $37 697 per year may be eligible for a contribution of around $500 from the Federal Government, and people earning between $37 697 and $52 697 may be eligible for a smaller contribution, depending on individual circumstances.

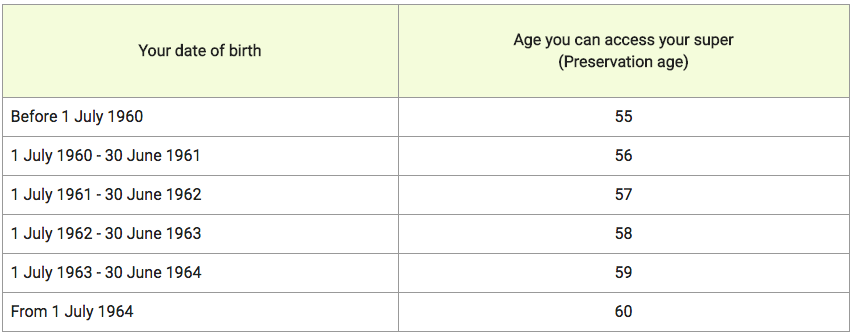

The laws surrounding retirement and collecting super funds are constantly changing and evolving with society. Below is a table of the current guidelines, however more updates are likely to come out in the future.

Table retrieved from: https://www.moneysmart.gov.au/superannuation-and-retirement/how-super-works

Beyond Debt is a trading name of DCS Group Aust Pty Ltd. Australian Credit License: 382607. RDAA Number: 1126. PO Box 3074 Newstead, QLD, 4006.

DCS Group operates under a Limited Liability scheme approved under Professional Standards Legislation